- A gross income of $250,000 or more per annum in each of the previous two financial years; or

- Net assets of at least $2.5 million; and

- A verified Qualified Accountant’s certificate given no more than two (2) years ago confirming the Sophisticated Investor status. Please refer to the Corporations Act: Specifically Section 708(08) and Section s761G(7)

Antimony

Antimony

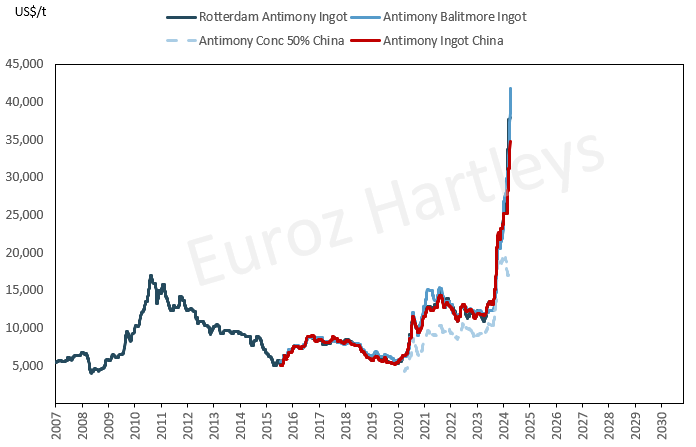

Antimony Price Action

The US has been aggressively rebuilding their domestic antimony market, and now with China enforcing an export ban to the US, has caused the critical mineral’s price to sky rocket over 300% in 2024.

Global fears around its highly concentrated supply have now been realised, as the Chinese Government announced in December 2024 a total export ban of antimony. It has seen the already-tight market scrambling for alternative suppliers and boosting the price to all-time highs.

Antimony 101

Antimony is a strategic critical mineral that is used in all manner of military applications, including the manufacture of armour piercing bullets, ammunition primers, and tracer ammunition. It also includes night vision goggles, infrared sensors, precision optics, laser sighting, explosive formulations, nuclear weapons and production, tritium production, flares, military clothing, and communication equipment.

China continued to be the leading global antimony producer in 2021, accounting for 55% of global mine production, followed by Russia at 23% and Tajikistan at 12%.

There were only 24 antimony mines operating globally in 2018 that produced 147kt, which declined to 110kt in 2021. China also continues to account for around 80% of processing capacity.

Another interesting growth opportunity for antimony is fibreglass composites, which are rapidly replacing conventional materials in many applications, such as aerospace, automobiles, construction, and electronics due to their high strength, low cost, easy processability and availability in various forms and shapes. It slides relatively easily into fibreglass manufacturing processes, as its added directly to resin which is dispersed using normal mixing equipment.

The second and third largest key uses for the critical mineral are flame retardants, and lead-acid batteries.

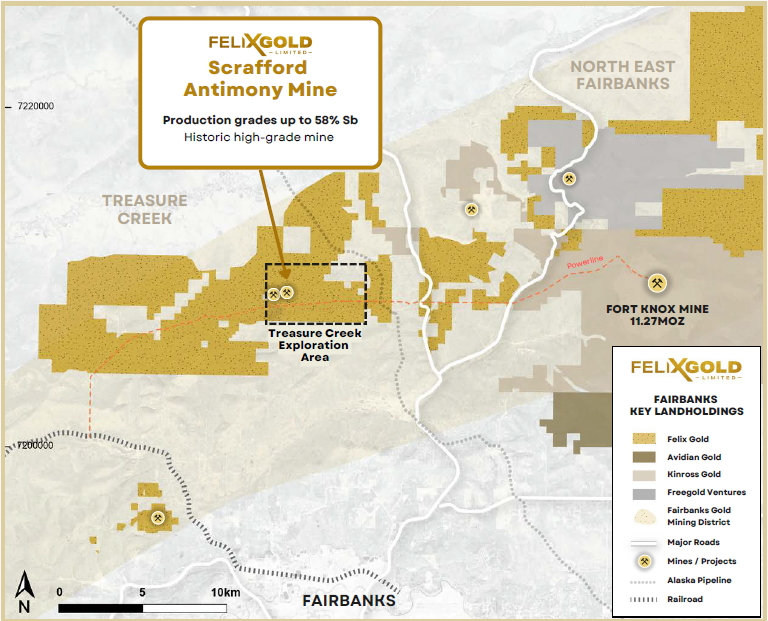

FXG Treasure Creek Antimony

The historic Scrafford Antimony Mine at Treasure Creek was one of Alaska’s largest antimony producers, achieving past production grades up to 58% Sb. Drilling results include: 15.2m @ 5.5% Sb from 21.3m, including 6.1m @ 13% Sb, 1.5m @ 26.1% Sb from 38.1m, and 6.1m @ 7.7% Sb from 3m, including 1.5m @ 28% Sb.

The company is now investigating near-term production, as Felix Gold assesses the viability of a stand-alone, near-term, high-grade and low-capex antimony production, including collaboration with relevant U.S. government agencies to support critical metal supply chain security.

Geologically the area is dominated by Devonian age meta-igneous and meta-sedimentary rocks, igneous rocks of Cretaceous and Tertiary age, and an unconformable cover sequence of Tertiary sedimentary rocks and gravels.

Known gold mineralisation is associated with veins, skarns and large-scale faults and is considered analogous to other Tintina Province Intrusive Related Gold occurrences.

American Antimony Action

The urgent need for supply and processing diversification has been repeatedly highlighted. The US used to have a healthy antimony market, which has since been reduced to nothing. The American Congress approved US$30.6 billion for munitions during fiscal 2024, US$5.8 billion more than 2023, and the industry was already experiencing supply shortages that will now be severely exacerbated by the ban.

The United States’ reliance on 100% imports of antimony, primarily from foreign countries such as China and Russia, has prompted the US Department of Defense to take significant actions. These efforts include prospecting and identifying local antimony suppliers and allocating $24.8 million to an old antimony mine in Idaho prior to the export ban. This funding aims to expedite environmental and engineering studies and finalize an investment decision.

Congress has taken a keen interest in the US’ antimony stockpiles in recent years, citing the significant security risk of both dwindling reserves and no domestic production. US$10 million has been allocated to the US Army for studies that are investigating domestic sourcing and production of antimony.

Felix Mineral Resources

View our updated Mineral Resource Statement